As an art outsider, is normal to think that abstract art gets sold for crazy prices. Auction houses as Christies and Sotheby’s also fuelled that trend. If an abstract piece of de Kooning sold in 2015 for 300 Million on a private sale can be a surprise for many, for who works is this field it actually isn’t. Abstract art is expensive.

So, why is abstract art so expensive? Abstract art is expensive for a simple reason. There is demand for it! Nowadays people buy art not just because they like it but because it can be a good financial investment. Adding this with the conspicuous consumption trend and the number of billionaires increasing out there, it’s easy to understand why some abstract art is so expensive.

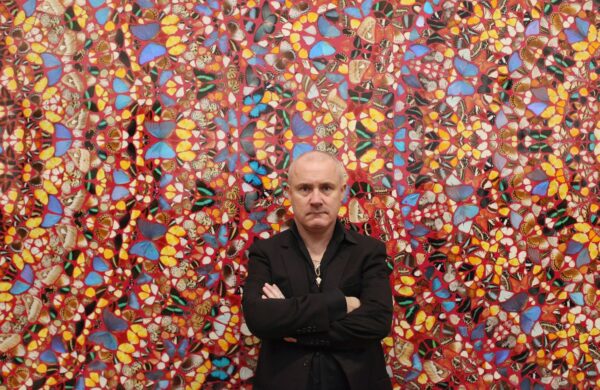

Untitled XIV, 1976. Oil on canvas (1904-1997) Fisher Collection SFMOMA Picture by: rocor

What makes abstract art so expensive?

When we speak about art pieces that are sold for huge numbers we are speaking about trophy art. Abstract art is sold by high prices due to different factors as conspicuous consumption, art as an investment and market speculation.

Conspicuous Consumption in the art market

Conspicuous consumption is the spending of money in acquiring luxury goods and services in order to display economic power. Thorstein Veblen created this term as a reaction to the over-the-top wastefulness of a gilt society.

Veblen had plenty to say about the arts and the reasoning behind their support. For him, our ideas of beauty were inextricably tied to rarity and expense. He compared art to diamonds. While similar in many ways to common glass, diamonds are rare in the earth’s crust and difficult to dig out. Seen under these contexts, they become beautiful. Further, while a Willem de Kooning oil might be worth big bucks, it’s also big bucks that make De Kooning worthy. Veblen noted that frivolities and false values came about due to the human need to demonstrate wealth and to establish status.

Art assets are appealing both for their ability to transfer consumption over time and for their use as signals of wealth. Adding art value to utility, returns also reflect this “conspicuous consumption” dividend.

If we look for the profile of the usual art buyer that is willing to give huge amounts of money in order to obtain art we can see a pattern.

a) They have at least over 5 million in their bank accounts

b) They have already a considerable amount of properties

c) They have at least one luxury car

So how can they now show to the world that they have money? Simple, buying art.

Abstract Art is a Good Investment

Buying art only to make properties looking aesthetically more pleasant is in the past. Nowadays art is bought also as an investment. And as an investment modern and contemporary art where we have the abstract one are the more profitable ones. Not only abstract paintings showed to mantain their price overtime, they also increase value between 4 to 8% year.

Art is a significant investment class, which is highly uncorrelated to other asset classes. Such uncorrelated categories in an investment portfolio can offset potential losses and generate good returns. As indicated by the performance of the art market in 2018. During the same period, other conventional markets floundered. To safeguard their portfolio in the long run, savvy investors are turning towards art to amplify their returns.

Art investment is becoming more critical than ever before since it is a viable choice for diversification. To maintain the financial strength of an investment during times of economic uncertainty. It is crucial to have asset classes at hand, which move independently of one another.

The Wall Street Journal declared art to be the best investment class in 2018. The art market performed far better than other markets during 2018, as evidenced by the numbers. Blue-chip artwork posted an average gain of 10.6%, whereas the S&P 500 securities fell by 5.1% during the same period. What makes this feat remarkable is that 2018 was an exceedingly difficult year during which several markets declined, including gold.

Market speculation

For starters, let’s take a crash course in the fundamentals of speculating. A speculator is someone who buys (invests) based not on current value and demand, but rather on predictions. The objective here is to resell at a higher price at that future, basically a vehicle to grow wealth.

That buyer, in turn, continues the speculation. Hoping to resell at a later date for a higher price to a subsequent speculator, who will in turn continue the speculation.

An aggravating factor, specific to speculating on art, is that art has no tangible value. Artists sit in their studios and manipulate various mediums into various forms. Then their galleries, dealers, or agents declare to be art, declare to be worth certain dollar amounts.

Most art buyers, that go to auctions at Sothebys and Christies , are art collectors or resellers that have something in common. Experience, knowlege and money. Imagine a collector who has some 10 works by Pollock. He certainly knows that if he buys a piece of the same artist for a higher value all his other 10 pieces of Pollock will increase value. The same applies to art dealers, who have some pieces by certain artists in their portfolio at a lower price than auction houses but by increasing the value of the artists on auction houses can resale his portfolio for a bigger price.

Conclusion

Art market never been so in fashion as nowadays. If before auctions at Sotheby’s and Christies were only for art professionals , nowadays contemporary auctions are more like a fashion week event. Therefore, opposite to the clothes value that decreases overtime, artworks tend to always increase, making it a safer investment that majority of the financial products out there. In the end as I said in the beginning there is only one major reason why abstract art sells for high prices. There is demand for it.

If you want to know more about how to invest in art have a look a our previous articles.

5 Reasons to invest in art: https://marianacustodio.com/5-reasons-to-invest-in-art/

Is art a good investment? 11 tips for new art collectors: https://marianacustodio.com/is-art-good-investment-11-tips-new-art-collectors/

Top collectors reveal the secrets of how to invest in art: https://www.bloomberg.com/news/features/2018-05-07/top-collectors-reveal-the-secrets-of-how-to-invest-in-art

Comments (01)